The finance sector stands at the forefront of adopting Artificial Intelligence (AI), leveraging its capabilities to transform financial services, decision-making processes, and customer interactions. AI’s introduction into finance has heralded a new era of efficiency, accuracy, and innovation, driving a significant shift towards AI-driven financial services. This introduction overviews AI’s impact on finance and explores the transition towards more intelligent, data-driven financial operations and services.

1. AI’s Impact on the Finance Sector

Overview of AI’s Impact on the Finance Sector

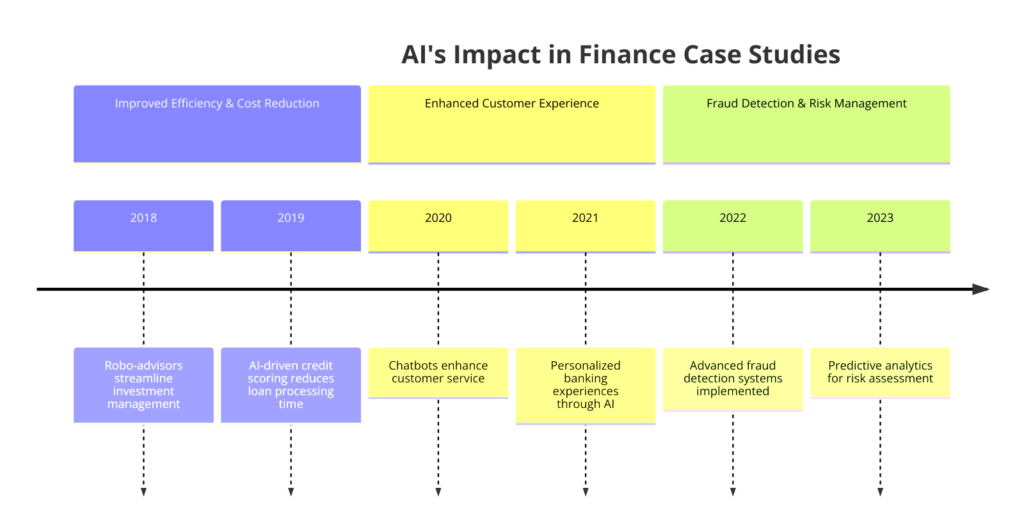

AI technologies, including machine learning, natural language processing, and predictive analytics, are reshaping the finance sector by automating complex tasks, enhancing analytical capabilities, and providing deeper insights into financial data.

From algorithmic trading and risk management to fraud detection and personalized banking services, AI’s applications in finance are vast and varied.

They offer substantial improvements in operational efficiency and customer satisfaction.

The Shift Towards AI-driven Financial Services

The adoption of AI in finance represents a paradigm shift, moving away from traditional, manual processes towards more agile, automated, and customer-centric operations.

This transition is driven by the need to rapidly process and analyze the increasing volume of financial data, make more informed decisions, and meet the growing expectations of tech-savvy consumers for personalized and convenient services.

- Enhanced Decision-Making: AI’s ability to analyze large datasets in real-time enables financial institutions to make more informed and timely decisions, whether in credit assessment, investment strategies, or risk management.

- Operational Efficiency: By automating routine tasks, AI allows financial organizations to reduce operational costs and focus resources on strategic activities, improving overall efficiency and competitiveness.

- Personalized Customer Experiences: AI facilitates personalized financial services, from tailored investment advice to customized banking solutions, enhancing customer engagement and loyalty.

The impact of AI on the finance sector is profound, transforming how financial institutions operate, make decisions, and interact with customers.

As AI technologies evolve, their integration into financial services is set to deepen, further automating operations, enhancing analytical capabilities, and creating more personalized customer experiences.

The journey of AI in finance is not just about technological advancement but also about reimagining the future of financial services in an increasingly digital world.

2. AI in Financial Analysis and Decision Making

Artificial Intelligence (AI) has revolutionized financial analysis and decision-making, offering unprecedented capabilities in understanding market dynamics, predicting trends, and informing investment strategies.

By harnessing AI, financial institutions and investors can navigate complex and fast-paced financial markets with enhanced precision and insight.

AI’s Role in Analyzing Financial Markets

AI technologies, particularly machine learning and predictive analytics, are adept at processing vast amounts of financial data from diverse sources, identifying patterns, and predicting market movements.

These capabilities enable more accurate and timely analysis, crucial for making informed investment decisions.

- Algorithmic Trading: AI algorithms analyze real-time market data to execute trades at optimal times, maximizing returns and minimizing risks. AI-driven algorithmic trading can outperform traditional trading strategies by identifying profitable trading opportunities based on historical data and market indicators.

- Market Sentiment Analysis: Natural language processing (NLP) tools evaluate news articles, social media posts, and financial reports to gauge market sentiment. This analysis provides valuable insights into how public perception and news events might influence market trends.

- Portfolio Management: AI systems offer personalized investment advice and portfolio management services, optimizing asset allocation based on an individual’s risk tolerance and investment goals. These “robo-advisors” can adapt to changing market conditions, ensuring optimal portfolio performance.

Case Studies of AI-driven Financial Analysis

- JP Morgan’s LOXM Program: JP Morgan’s implementation of the LOXM program, an AI-driven system for executing trades, has significantly improved the efficiency and effectiveness of trade execution, reducing transaction costs and slippage for their clients.

- BlackRock’s Aladdin Platform: The Aladdin platform utilizes AI and big data analytics to provide comprehensive risk analysis, portfolio management, and operational tools for investors and asset managers, offering deep insights into market risks and opportunities.

- Quantitative Hedge Funds: Hedge funds like Renaissance Technologies and Two Sigma have leveraged AI and machine learning algorithms to analyze market data, identify patterns, and make highly profitable trading decisions, showcasing the potential of AI in quantitative finance.

The application of AI in financial analysis and decision-making has fundamentally changed the finance sector, offering tools that provide deeper market insights, enhance investment strategies, and improve the efficiency of trading operations.

As AI technologies advance, their impact on financial analysis and decision-making will only grow, further empowering financial institutions and investors with sophisticated analytical capabilities.

The future of finance lies in leveraging AI to navigate market complexities with greater agility and informed insight, paving the way for more strategic and prosperous financial decisions.

3. AI in Risk Management

Artificial Intelligence (AI) is pivotal in transforming risk management within the finance sector.

Financial institutions can now anticipate and mitigate risks with unprecedented accuracy and efficiency by leveraging AI’s predictive analytics, machine learning models, and data processing capabilities.

Role of AI in Assessing and Managing Financial Risks

- Credit Risk Assessment: AI models analyze vast amounts of financial data, including credit history, transaction data, and social media activity, to assess the creditworthiness of borrowers. These models can predict the likelihood of default more accurately than traditional credit scoring methods, allowing lenders to make more informed lending decisions.

- Market Risk Analysis: AI algorithms help identify and quantify market risks by analyzing historical and current market data. These tools can simulate various market scenarios to predict potential impacts on investment portfolios, enabling proactive risk management strategies.

- Operational Risk Management: AI detects transaction data anomalies, identifies fraudulent activities, and monitors compliance with regulatory requirements. By automating the detection of operational risks, financial institutions can prevent losses and ensure regulatory compliance more effectively.

Examples of AI Applications in Risk Management

- JPMorgan Chase’s COiN Platform: JPMorgan Chase has developed the Contract Intelligence (COiN) platform, which uses NLP and machine learning to analyze legal documents and extract important data points and clauses. This tool significantly reduces the operational risks associated with manual review and compliance processes.

- Fraud Detection Systems: AI-powered fraud detection systems analyze real-time transaction patterns to identify suspicious activities. They can learn from historical fraud data to improve their detection capabilities, helping financial institutions minimize fraud losses.

- Stress Testing Models: Financial regulators and institutions use AI models to test how banks and financial systems fare under extreme but plausible adverse economic scenarios. AI enhances the accuracy of stress testing models, providing deeper insights into systemic risks.

AI’s contribution to risk management in the finance sector is transformative, enabling more sophisticated, accurate, and proactive approaches to identifying and mitigating risks.

By harnessing the power of AI, financial institutions can enhance their risk assessment processes and improve their overall resilience to economic uncertainties.

As AI technologies evolve, their application in risk management is expected to become even more integral to the finance sector, driving innovation and safeguarding against potential threats.

4. AI in Fraud Detection and Prevention

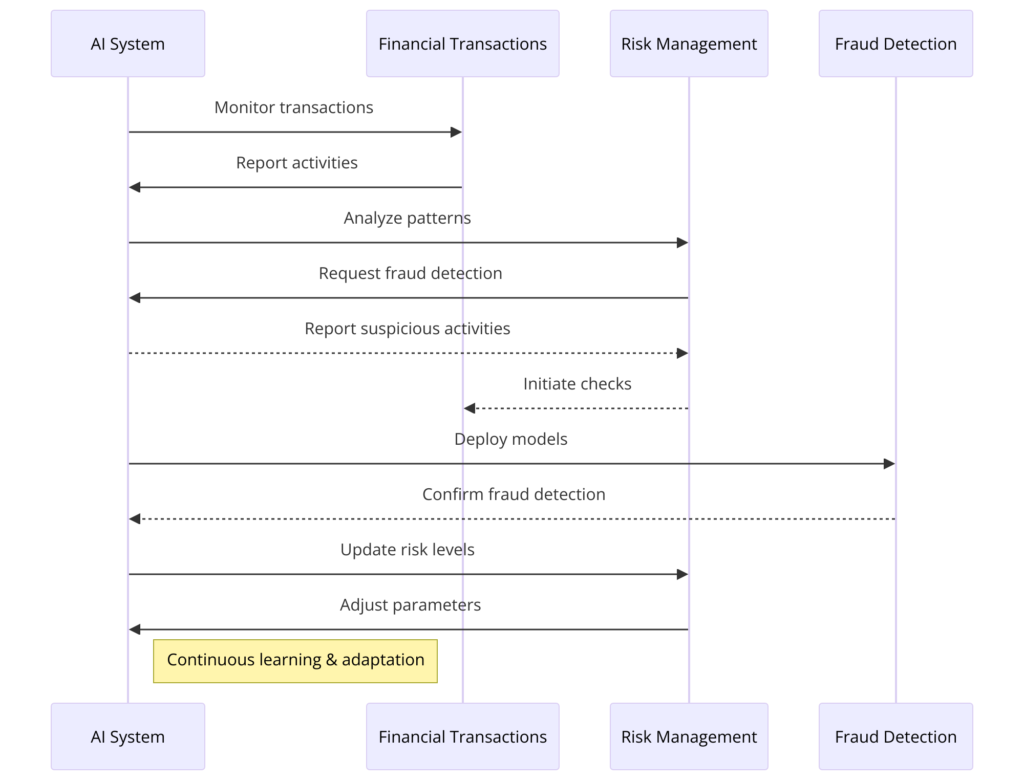

Artificial Intelligence (AI) is revolutionizing fraud detection and prevention in the finance sector.

By leveraging machine learning algorithms, pattern recognition, and anomaly detection capabilities, AI systems can identify fraudulent activities more accurately and quickly than traditional methods.

Use of AI in Detecting and Preventing Financial Fraud

- Machine Learning for Anomaly Detection: Machine learning models are trained on vast datasets of transactional data to learn standard behavior patterns. These models can then identify anomalies or deviations from these patterns, flagging potentially fraudulent activities for further investigation.

- Natural Language Processing for Document Verification: AI-powered NLP technologies analyze textual data within documents for inconsistencies or alterations. This is particularly useful in verifying the authenticity of financial papers and detecting identity theft.

- Predictive Analytics for Fraud Risk Assessment: Predictive analytics use historical data to predict future fraudulent activities. By analyzing trends and patterns in past fraud cases, AI systems can assess the risk of fraud in real-time transactions, allowing financial institutions to address potential threats preemptively.

AI Technologies and Methods for Fraud Detection

- Deep Learning: Deep learning models, particularly neural networks, effectively detect complex fraud schemes by processing large volumes of data and identifying subtle patterns indicative of fraud.

- Behavioral Biometrics: AI-driven behavioral biometrics analyze patterns in user behavior, such as typing speed, mouse movements, and navigation patterns, to authenticate users and detect unauthorized access.

- Graph Analytics: AI-enhanced graph analytics visualize relationships and connections between transactions, accounts, and users. This method is effective in uncovering sophisticated fraud rings and money laundering activities.

Case Studies Highlighting the Impact of AI in Fraud Detection

- PayPal’s AI Fraud Detection: PayPal uses AI and machine learning to analyze billions of transactions and distinguish between legitimate and fraudulent activities. This AI-driven approach has significantly reduced false positives, improving customer experience while maintaining security.

- Mastercard’s Decision Intelligence: Mastercard’s Decision Intelligence technology applies AI to score each transaction’s fraud potential, considering the transaction’s context and the cardholder’s profile. This system enhances the accuracy of real-time fraud detection in credit card transactions.

AI’s role in fraud detection and prevention represents a significant advancement for the finance sector, offering more sophisticated and efficient tools to combat financial fraud.

As fraudulent schemes become more complex, AI’s importance in identifying and preventing fraud will grow.

By continuously improving AI technologies and methods for fraud detection, financial institutions can more effectively protect their assets and customers, ensuring trust and security in the economic system.

5. AI in Personalized Banking and Customer Services

Artificial Intelligence (AI) significantly enhances customer experience in the banking sector by enabling personalized banking and customer services.

By using AI technologies like chatbots, predictive analytics, and personalized recommendation systems, banks can offer customized advice, optimize customer interactions, and deliver services that more effectively meet individual customer needs.

AI’s Role in Enhancing Customer Experience

- Personalized Financial Advice: AI-driven platforms analyze customers’ financial data, spending habits, and goals to provide personalized advice on budgeting, saving, and investing. This customized approach helps customers make more informed financial decisions.

- Chatbots for Customer Service: AI-powered chatbots handle inquiries, transactions, and customer service requests 24/7, offering immediate responses and reducing wait times. These chatbots can understand and process natural language queries, making interactions more intuitive and efficient.

- Predictive Analytics for Customized Offers: Banks use AI to analyze customer behavior and preferences, predict future financial needs, and offer customized products and services. This predictive capability enables banks to meet customer needs, enhancing satisfaction and loyalty proactively.

Implementation of AI in Personalized Banking

- Machine Learning for Customer Segmentation: Machine learning algorithms segment customers based on their behavior and preferences, allowing banks to tailor their marketing efforts and product offerings to specific customer groups.

- Data Analytics for Improved Customer Insights: AI-driven data analytics give banks deeper insights into customer behavior, enabling more targeted and effective service offerings.

- Voice Recognition for Secure Transactions: Voice recognition technology, powered by AI, adds security to banking transactions and services. It allows customers to use voice commands for banking operations while verifying their identity.

Case Studies Highlighting the Impact of AI in Customer Services

- Bank of America’s Erica: Erica, a virtual financial assistant introduced by Bank of America, uses AI to help customers make payments, check balances, and receive personalized financial advice, significantly improving the customer banking experience.

- Capital One’s Eno: Capital One’s Eno is an AI-powered chatbot that assists customers with account inquiries, fraud alerts, and bill payments. Eno can also provide insights into spending trends and help customers manage their finances more effectively.

Integrating AI in personalized banking and customer services is transforming the banking sector, making it more responsive, efficient, and customer-centric. By leveraging AI technologies, banks can provide customized experiences that meet their customers’ evolving expectations, fostering stronger relationships and loyalty. As AI advances, its role in delivering personalized banking services will undoubtedly expand, further enhancing customer experience and revolutionizing banks’ operations.

6. Challenges and Ethical Considerations in AI-driven Finance

While integrating Artificial Intelligence (AI) into the finance sector offers significant benefits, it also presents challenges and ethical considerations.

These concerns range from data privacy and security to the implications of automated decision-making for financial equity and access.

Addressing these issues is crucial for ensuring that the deployment of AI in finance is responsible, transparent, and equitable.

Addressing Privacy and Data Security

AI systems in finance rely heavily on personal and financial data to make predictions and decisions and offer personalized services.

Given the sensitive nature of financial information and the potential consequences of data breaches, the privacy and security of this data are paramount.

- Data Privacy: Financial institutions must navigate stringent regulations regarding data privacy, such as GDPR in Europe and CCPA in California, ensuring that customer data used to train AI models is collected, stored, and processed in compliance with these laws.

- Cybersecurity Threats: Relying on AI and digital platforms increases vulnerability to cyberattacks. Financial institutions must employ advanced cybersecurity measures to protect against threats that could compromise AI systems and customer data.

Ethical Dilemmas in Automated Decision-making

Automating financial decision-making processes through AI can lead to ethical dilemmas concerning fairness, transparency, and accountability.

- Bias and Fairness: AI models can inadvertently perpetuate or amplify biases in their training data, leading to unfair treatment of individuals or groups in lending, investing, and other financial services. A significant ethical challenge is ensuring AI systems are free from bias and operate fairly.

- Transparency and Explainability: Some AI algorithms’ “black box” nature makes it difficult to understand how decisions are made. This lack of transparency can challenge accountability, especially when AI-driven decisions have significant financial implications for individuals.

- Dependence on Algorithms: Over-reliance on AI for financial decision-making raises concerns about the loss of human judgment and oversight. Balancing AI automation with human expertise is crucial to mitigate risks associated with algorithmic errors or failures.

Strategies for Responsible AI Use in Finance

- Ethical AI Frameworks: Developing and implementing ethical guidelines and frameworks for AI use in finance can help address privacy, bias, and transparency issues. These frameworks should promote ethical AI development and deployment practices.

- Continuous Monitoring and Auditing: Regularly monitoring and auditing AI systems for accuracy, fairness, and security can help identify and rectify potential issues, ensuring AI systems remain aligned with ethical standards and regulatory requirements.

- Stakeholder Engagement: Engaging a broad range of stakeholders, including customers, regulators, and ethics experts, in discussions about the use of AI in finance can foster a more holistic understanding of ethical considerations and promote more responsible AI practices.

While AI-driven finance offers transformative potential, navigating the associated challenges and ethical considerations is essential for harnessing this technology responsibly.

By prioritizing data privacy, ensuring fairness, and maintaining transparency and human oversight, the finance sector can leverage AI to enhance efficiency and innovation, uphold ethical standards, and foster consumer trust.

The future of AI in finance depends on a balanced approach that recognizes both the technology’s benefits and potential risks.

7. The Future of AI in Finance

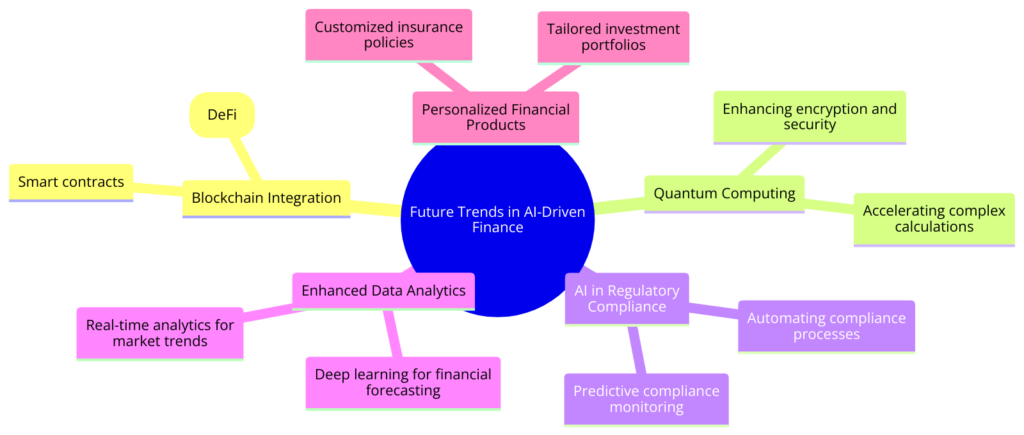

Artificial Intelligence (AI) integration within the finance sector is set to deepen, promising to revolutionize further financial services, decision-making processes, and customer interactions.

As we look towards the future, AI’s evolving role in finance is anticipated to bring more sophisticated, efficient, and personalized financial solutions.

Predictions for AI’s Evolving Role in Finance

- Advanced Predictive Analytics: AI’s capabilities in predictive analytics are expected to become even more sophisticated, enabling financial institutions to forecast market trends, customer behavior, and potential risks with greater accuracy. This advancement will support more informed strategic decision-making and risk management.

- Automated Personalized Financial Planning: AI will drive the development of highly personalized financial planning services, using individuals’ financial data and behavioral patterns to tailor advice and recommendations precisely to each user’s needs and goals.

- Enhanced Fraud Detection Techniques: As financial fraud schemes become more complex, AI’s role in detecting and preventing fraud will evolve, employing more advanced algorithms to identify and mitigate fraudulent activities across digital platforms.

Emerging Trends and Potential Future Developments

- Blockchain and AI Integration: The convergence of AI with blockchain technology promises to enhance security, transparency, and efficiency in financial transactions. AI can analyze blockchain data to identify trends and anomalies, while blockchain can provide a secure and immutable record of AI-driven financial decisions.

- AI in Decentralized Finance (DeFi): AI is expected to play a significant role in the burgeoning field of decentralized finance, optimizing innovative contract functionalities, liquidity pooling, and algorithmic trading strategies within the blockchain ecosystem.

- Ethical AI and Regulation: As AI becomes more ingrained in financial services, developing ethical AI frameworks and regulatory standards will be crucial. These measures will ensure that AI-driven finance operates transparently, equitably, and securely, maintaining public trust and compliance with global financial regulations.

The future of AI in finance is marked by continuous innovation and the potential for transformative changes that enhance how financial services are delivered and consumed.

By harnessing AI’s power, the financial sector can offer more accurate analytics, personalized services, and robust security measures, catering to the evolving demands of the digital economy.

However, realizing this potential will require navigating ethical considerations and regulatory challenges, ensuring that AI’s integration into finance benefits all stakeholders and fosters a more inclusive and resilient financial system.

Encouraging continuous innovation and responsible and ethical use of AI will be vital in shaping a future where finance is more accessible, efficient, and secure for everyone.

8. Conclusion: AI’s Transformative Impact in Finance

The exploration of Artificial Intelligence (AI) within the finance sector has unveiled its profound capacity to transform financial services, risk management, fraud detection, and customer engagement.

As we have traversed through AI’s applications in financial analysis, personalized banking, and beyond, it’s clear that AI is not just a technological advancement—it’s a pivotal force reshaping the economic sector.

This concluding section recaps AI’s transformative impact on finance and underscores the importance of continuous innovation and responsible AI use.

AI’s integration into finance has demonstrated significant benefits, from enhancing decision-making processes with sophisticated analytics to personalizing customer experiences.

These advancements have improved operational efficiencies and opened new avenues for financial inclusion, allowing more individuals to access and benefit from financial services tailored to their unique needs.

However, the journey of AI in finance is accompanied by challenges and ethical considerations that demand attention.

Issues surrounding data privacy, security, and the ethical use of AI highlight the need for a balanced approach where innovation is matched with responsibility.

Addressing these challenges is crucial for fostering trust and ensuring that the benefits of AI in finance are realized equitably and sustainably.

Encouraging Continuous Innovation and Responsible Use of AI

The future of AI in finance hinges on the sector’s ability to innovate responsibly. Financial institutions, technologists, regulators, and consumers must collaborate to create an ecosystem that supports ethical AI development and deployment. This collaborative effort should focus on:

- Advancing AI Technology: Continuing to push the boundaries of what AI can achieve in finance, exploring new applications, and refining existing models to enhance accuracy, efficiency, and accessibility.

- Fostering Ethical AI Practices: Developing and adhering to ethical guidelines and standards prioritizing fairness, transparency, and accountability in AI applications within finance.

- Regulatory Engagement: Working closely with regulatory bodies to ensure AI in finance aligns with legal frameworks and consumer protection standards, adapting to the evolving technological sector.

As we look to the future, AI’s role in finance is poised for further expansion and deeper integration.

The potential for AI to drive innovation, inclusivity, and resilience in finance is immense, offering a vision of a financial sector that is more responsive to the needs of society.

By embracing continuous innovation and committing to the responsible use of AI, the finance sector can navigate the complexities of the digital age, unlocking opportunities for growth, efficiency, and enhanced financial well-being for individuals and communities worldwide.

FAQ & Answers

1. How is AI used in finance?

AI is used for financial analysis, risk management, fraud detection, and personalized banking services, enhancing efficiency and customer experience.

2. What are the challenges of implementing AI in finance?

Challenges include data privacy, security concerns, ethical implications, and the need to balance AI automation with human expertise.

Quizzes

Quiz 1: “AI in Finance” – Identify AI applications in finance scenarios

Here are several scenarios where AI technology is making an impact. Your challenge is to identify the specific AI application or technology being used in each scenario:

- Fraud Detection System: A bank employs a system that analyzes customer transactions in real-time to detect unusual patterns and potential fraudulent activities. This system can learn from historical fraud data and adapt to new, sophisticated types of fraud, thereby protecting customers’ accounts from unauthorized access and transactions.

- Algorithmic Trading: An investment firm uses an advanced system that can execute trades at high speeds based on a set of criteria derived from various data sources, including market conditions, economic indicators, and social media sentiment. This system can adapt its trading strategies in real-time to maximize profits.

- Credit Scoring Models: A fintech company develops a new credit scoring model that incorporates traditional financial histories with alternative data such as rental payment history, utility bill payments, and even social media activity to determine an individual’s creditworthiness. This model aims to provide more accurate risk assessments and extend credit to underserved populations.

- Personalized Banking Experience: A banking app employs AI to analyze users’ spending habits, recurring payments, and financial goals. Based on this analysis, it offers personalized financial advice, savings tips, and investment recommendations tailored to each user’s unique financial situation.

- Robotic Process Automation (RPA) for Operational Efficiency: A financial institution implements RPA bots to automate routine tasks such as data entry, account reconciliation, and processing loan applications. These bots can work around the clock, reducing errors and increasing operational efficiency.

- Chatbots for Customer Service: A credit card company integrates a chatbot into its customer service operations, capable of handling inquiries about card features, transaction disputes, and account updates. The chatbot uses natural language processing to understand and respond to customer queries in a conversational manner, improving response times and customer satisfaction.

Here are the AI applications or technologies being used in each of the finance scenarios:

- Fraud Detection System: The technology at play is Machine Learning-based Fraud Detection. These systems analyze transactions to identify potentially fraudulent activity by learning from patterns found in historical data and continuously adapting to detect new types of fraudulent behaviors.

- Algorithmic Trading: This scenario uses Algorithmic Trading Systems with AI optimization. These systems execute trades at high speeds using algorithms that process a variety of data sources, including market trends, economic indicators, and even social media sentiment, to make decisions and adapt strategies in real-time.

- Credit Scoring Models: The application here is AI-enhanced Credit Scoring that incorporates machine learning algorithms to assess creditworthiness using not just traditional financial data but also alternative data sources. This approach enables more nuanced risk assessments and can expand credit access to previously underserved populations.

- Personalized Banking Experience: This is an example of AI-driven Personal Finance Assistance. By analyzing personal financial data, these AI systems provide customized advice, savings strategies, and investment recommendations, enhancing the banking experience through personalization.

- Robotic Process Automation (RPA) for Operational Efficiency: The technology used is Robotic Process Automation (RPA), which automates repetitive and routine tasks within financial operations. This not only increases efficiency and accuracy but also frees up human employees to focus on more complex tasks that require human judgment.

- Chatbots for Customer Service: This scenario utilizes AI-powered Chatbots that employ natural language processing (NLP) to understand and respond to customer inquiries. These chatbots can provide immediate, 24/7 customer service for a wide range of queries, from simple account questions to more complex transaction issues, significantly improving customer service efficiency and satisfaction.

Each of these applications demonstrates the power of AI to transform the finance sector, improving efficiency, accuracy, and customer experience while also opening up new possibilities for services and operations.

Quiz 2: “Innovations in AI-driven Finance” – A quiz on recent AI innovations in the finance sector.

For this quiz, I’ll outline a few recent innovations in AI-driven finance. Try to identify the specific innovation or the type of technology being described. Let’s see how well you can spot these cutting-edge applications!

- Enhanced Due Diligence with AI: This recent innovation involves using AI to analyze a vast array of data sources, including public records, social media, and news articles, to perform due diligence on potential investments or partnerships. It significantly reduces the time and resources needed for financial analysts to vet companies and individuals, making the process more efficient and comprehensive.

- Blockchain and AI Integration for Secure Transactions: By integrating AI with blockchain technology, this innovation aims to enhance the security and efficiency of transactions. AI algorithms are used to detect anomalies and potential fraud in real-time on the blockchain, ensuring the integrity of transactions and smart contracts.

- AI-driven Behavioral Finance Models: These models use AI to analyze investor behavior and market trends to predict financial market movements. By understanding the psychological factors that influence investment decisions, these AI models can anticipate shifts in market dynamics and provide more accurate forecasts.

- Natural Language Generation for Financial Reporting: This technology uses AI to automatically generate financial reports, market summaries, and investment research documents. By analyzing financial data, these AI systems can produce coherent narratives and insights, streamlining the reporting process and freeing up analysts to focus on strategy and analysis.

- Quantum Computing for Complex Financial Modeling: While still in the early stages, this innovation combines quantum computing with AI to solve complex financial models that are beyond the capability of traditional computers. This could revolutionize risk assessment, portfolio optimization, and other areas where the financial sector relies on heavy computational power.

- AI for Sustainable Investing: This innovation uses AI to analyze and score investments based on environmental, social, and governance (ESG) criteria. It helps investors identify opportunities that align with sustainability goals, providing insights into the long-term viability and impact of their investment choices.

Each description highlights a cutting-edge application of AI in finance. What do you think these innovations are, or what type of technology is being described?

Here are the specific innovations or types of AI-driven technology being described in the finance sector:

- Enhanced Due Diligence with AI: This refers to the use of AI in Enhanced Due Diligence processes. The innovation lies in leveraging machine learning and natural language processing to quickly analyze vast datasets, enhancing the ability of financial institutions to conduct thorough background checks and risk assessments more efficiently than traditional methods.

- Blockchain and AI Integration for Secure Transactions: The innovation here is the Integration of AI with Blockchain Technology. AI enhances blockchain’s capabilities by providing advanced analytics for detecting fraudulent transactions and ensuring the integrity of data on the blockchain, thereby enhancing the security and efficiency of digital transactions.

- AI-driven Behavioral Finance Models: This describes Behavioral Finance Models powered by AI, which analyze data on investor behavior to predict market movements. By incorporating psychological insights into financial models, AI helps forecast market trends more accurately, taking into account the irrational behaviors of investors that traditional models might overlook.

- Natural Language Generation for Financial Reporting: The technology involved is Natural Language Generation (NLG) for Financial Reporting. AI systems automatically analyze financial data to generate reports, summaries, and documents, using natural language to present complex information in an accessible and understandable format, thus streamlining financial communications.

- Quantum Computing for Complex Financial Modeling: This innovation involves the use of Quantum Computing in conjunction with AI for Financial Modeling. Quantum computers, with their superior processing power, enable the handling of complex calculations much faster than traditional computers, and when combined with AI, can significantly advance financial modeling, risk management, and optimization tasks.

- AI for Sustainable Investing: This refers to AI-powered Tools for ESG Investing. By analyzing vast amounts of data on environmental, social, and governance factors, AI provides investors with insights into the sustainability and ethical impact of their investments, helping them make informed decisions that align with their values and the growing demand for responsible investing.

Each of these answers illustrates how AI is driving innovation in the finance sector, from improving security and efficiency to enabling more informed and ethical investment decisions.